A few posts ago, we shared with you the Step by Step Guide: Tax Configuration in Magento | Adobe Commerce. However, we didn’t pay a lot of attention to European taxes. Today we’re going to make it right and deal with the VAT configuration in Magento | Adobe Commerce.

VAT Configuration

As an example, we’ll set up Value-Added Tax for France.

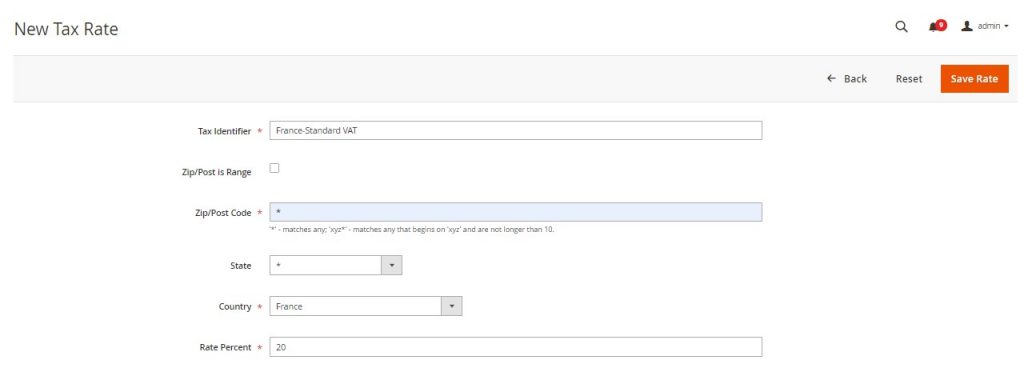

Step 1. New Create Tax Rate

1.Admin Sidebar > Stores > Tax Zone and Rate > Add New Tax Rate

2.Create two Tax Rates:

a. Tax Identifier: France-Standard VAT

Country: France

State/Region: *

ZIP/Postal Code: *

Rate: 20

b.Tax Identifier: France-Reduced VAT

Country: France

State/Region: *

ZIP/Postal Code: *

Rate: 5

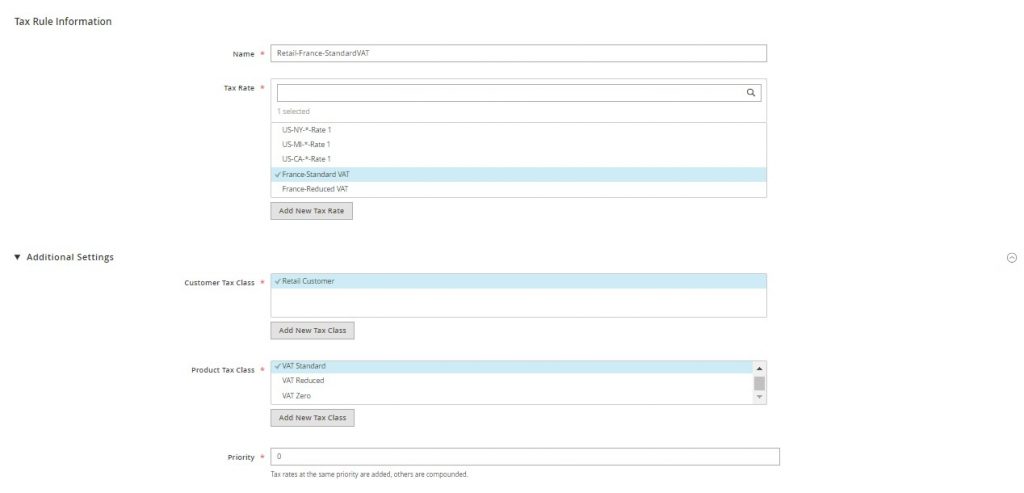

Step 2. Create New Tax Rule

1.Admin Sidebar > Stores > Tax Rules > Add New Tax Rule

2.Create the following Tax Rules:

a. Retail-France-StandardVAT

Settings:

Customer Class: Retail Customer

Tax Class: VAT-Standard (add new product tax class by clicking Add New Tax Class)

Tax Rate: France-StandardVAT

Priority: 0

Sort Order: 0

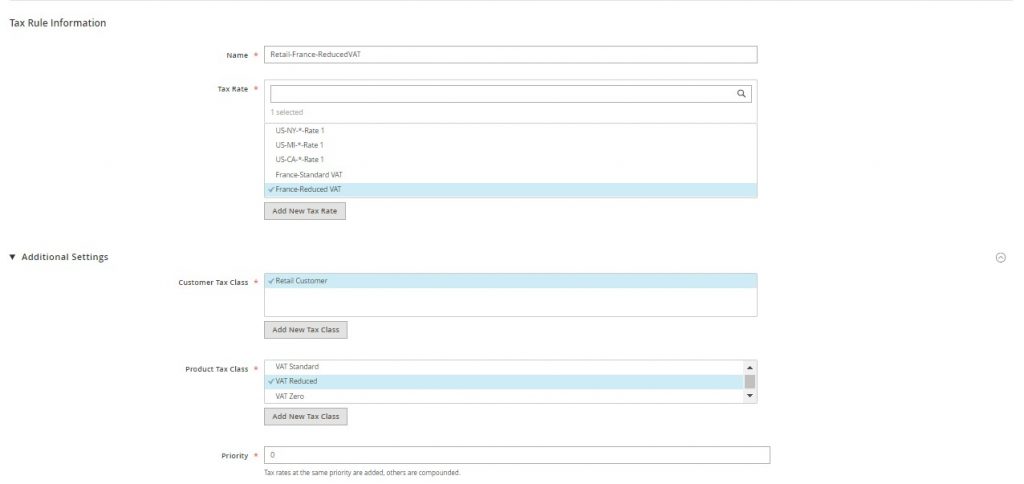

b. Retail-France-ReducedVAT

b. Retail-France-ReducedVAT

Settings:

Customer Class: Retail Customer

Tax Class: VAT Reduced

Tax Rate: France-ReducedVAT (add new product tax class by clicking Add New Tax Class)

Priority: 0

Sort Order: 0

Step 3. Configure Tax Settings for France

1.Admin Sidebar > Stores > Configuration > Sales > Tax

2.Complete general settings the next way:

| FIELD | RECOMMENDED SETTING |

| Tax Classes | Default |

| Calculation Settings | |

| Tax Calculation Method Based On | Total |

| Tax Calculation Based On | Shipping Address |

| Catalog Prices | Including Tax |

| Shipping Prices | Including Tax |

| Apply Customer Tax | After Discount |

| Apply Discount on Prices | Including Tax |

| Apply Tax On | Custom Price (if available) |

| Default Tax Destination Calculation | |

| Default Country | France |

| Default State | |

| Default Postal Code | * (asterisk) |

| Shopping Cart Display Settings | |

| Include Tax in Grand Total | Yes |

| Fixed Product taxes | |

| Enable FPT | Yes |

| All FPT Display Settings | Including FPT and FPT description |

| Apply Discounts to FPT | No |

| Apply Tax to FPT | Yes |

| Include FPT in Subtotal | Yes |

Step 4. Apply Tax Classes to Products

- Catalog > Products.

- Open a product from your catalog in edit mode.

- On the General page, find the Tax Class field. Then, select the VAT Class that applies to the product.

- When complete, click the Save button.

![]() Mobecls team offers fixed-price service packages for Magento store support. Moreover, we’ll help you to choose a plan according to your business needs and specifics. The starting price is $2000. You can also select the number of working hours and the range of services. A service package may include updates, the installation of modules, bug fixing, SEO support and many more. Contact us and we’ll help you.

Mobecls team offers fixed-price service packages for Magento store support. Moreover, we’ll help you to choose a plan according to your business needs and specifics. The starting price is $2000. You can also select the number of working hours and the range of services. A service package may include updates, the installation of modules, bug fixing, SEO support and many more. Contact us and we’ll help you.